Purchasing a vehicle often involves financing, especially for those who prefer spreading the cost over time through methods like Hire Purchase (HP) or Personal Contract Purchase (PCP). While these financing options make car ownership more accessible, they come with specific implications for car insurance and ownership rights.

Understanding these impacts is crucial for any car buyer to avoid potential pitfalls and ensure a smooth ownership experience. In order to avoid these kinds of pitfalls, perform an outstanding finance check to save your hard earned money.

This blog delves into the complexities of how outstanding finance affects car insurance and ownership.

Car Ownership and Outstanding Finance

When you buy a car on finance, mainly through HP or PCP, you don’t own the car outright until you’ve made all the agreed payments. Instead, the finance company retains ownership of the vehicle. This arrangement has several implications:

- Legal Ownership: During the finance term, the finance company is the legal owner of the vehicle. You only gain full ownership once all payments are completed. This means you need the finance company’s permission to sell or modify the car in any significant way.

- Selling the Car: Selling a car with outstanding finance is generally not allowed unless the finance is settled in full. If you try to sell a vehicle with outstanding finance without clearing the debt, you could face legal repercussions. The buyer could also face complications, as they wouldn’t gain legal ownership until the finance is settled.

- Repossession Risk: If you fail to keep up with your finance payments, the finance company has the right to repossess the vehicle. This could occur without a court order if you’ve paid less than one-third of the total amount owed. For payments above this threshold, a court order would be required for repossession.

Impact on Car Insurance

Car insurance is another critical area affected by outstanding finance. Insurers consider several factors related to the finance agreement when determining your policy terms and coverage. Here’s how outstanding finance impacts your car insurance:

- Insurance Requirements: Most finance agreements require you to have comprehensive car insurance. This ensures that the vehicle is adequately covered in case of theft, damage, or an accident. Failing to maintain the required insurance can breach the finance agreement, leading to potential repossession or other penalties.

- Insurable Interest: Since you are not the legal owner of the car during the finance term, you need to disclose the finance arrangement to your insurer. The finance company’s interest in the vehicle needs to be acknowledged in the insurance policy. This is typically done through a clause that notes the finance company as an interested party.

- Claims and Payouts: In the event of a total loss (e.g., the car is written off due to an accident or theft), the insurance payout goes to the finance company first to settle any outstanding finance. If the payout exceeds the remaining finance, you will receive the balance. Conversely, if the payout is less than the outstanding finance, you would be responsible for covering the shortfall.

- GAP Insurance: To protect against the possibility of an insurance payout not covering the outstanding finance, many finance agreements recommend or require Guaranteed Asset Protection (GAP) insurance. GAP insurance covers the difference between the car’s market value (what your comprehensive insurance would pay) and the amount you owe on your finance agreement

Practical Scenarios and Solutions

Understanding the nuances of how outstanding finance affects car insurance and ownership can help you navigate potential issues effectively. Here are some practical scenarios and tips:

- Early Termination of Finance Agreement: If you wish to end your finance agreement early, either by settling the outstanding finance or using the voluntary termination option (available if you’ve paid at least half the total amount), ensure all insurance requirements are met during the process. Communicate with both the finance company and your insurer to update them on any changes.

- Changing Insurance Providers: If you decide to switch insurance providers, you must inform the new insurer about the finance agreement. Failing to disclose this information can lead to claims being denied or policies being invalidated. Ensure the new policy includes the finance company as an interested party.

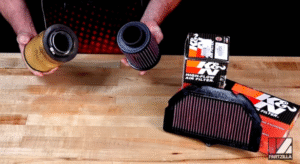

- Modifying the Vehicle: Any significant modifications to the vehicle, such as installing aftermarket parts or changing its appearance, typically require approval from the finance company. Additionally, these modifications must be disclosed to your insurer, as they can affect the coverage and premiums. Unauthorized modifications can breach the finance agreement and invalidate your insurance.

- Handling a Write-Off: If your financed car is written off, promptly contact both the finance company and your insurer. The insurer will assess the vehicle and determine the payout amount, which will first go to the finance company. If there’s a shortfall, you may need to negotiate a settlement plan or use GAP insurance if you have it.

Conclusion

Navigating the complexities of outstanding finance in relation to car insurance and ownership requires a clear understanding of the associated risks and responsibilities. Ensuring you have comprehensive insurance, disclosing all necessary information to your insurer, and adhering to the terms of your finance agreement are essential steps to safeguard your interests.

By being proactive and informed, you can enjoy the benefits of car financing while mitigating potential challenges and ensuring a smooth ownership experience.